Mutual funds define as a company that pools money together. The money from investors used for the purpose of making several different types of investments. This pool of investments – which is combination of stocks, bonds, and money market funds consider as a portfolio.

The professional investment managers are responsible for managing mutual funds and implementing investment strategies. Their role is to analyze market trends and economic conditions to make informed investment decisions for the fund. Investment management involves portfolio construction, risk management, and asset allocation to maximize returns for investors. It requires technical skills in financial analysis, forecasting, and investment evaluation. Investors should carefully consider the investment objectives and risks associated with mutual funds before investing, and look for investment managers with a track record of success in investment management.

Evidently, the condition of the mutual fund directly affects each individual investor. You can understand in this way, when the mutual fund profits, investors gain a dividend. And when the mutual fund suffers a low, the effectiveness of the investor’s shares reduce.

Table of Contents

Learn more about Mutual fund investment:

Mutual funds are, by nature, expanded types of investments. What it simply means is that they are embraced of many different investments. So to speak, it suggests for the investor to avoid having all of their eggs in one basket. If it practice there is generally a much lower risk involve.

It is of course the responsibility of the fund manager to make sure that the mutual fund performs as well as it possibly could. This is after all what the investor’s are paying him or her for. With the fund manager’s income based on how effectively he or she is able to increase the fund, it is in their best interests to make sure that it performs well.

Because investors assign the job of managing the fund to someone else, they do not have to bother with diversifying the investments themselves or even keeping their own records. In most cases, investors can simply buy stocks and forget about them. Of course since it is your money that is at stake, you will want to be inform about the status of your investments from time to time.

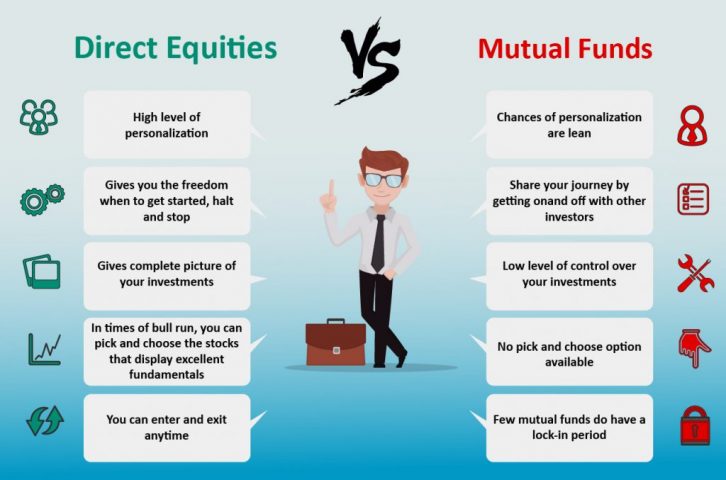

How to compare direct equities to mutual funds?

Direct equities gives you a complete view of your investments while mutual funds have low-level of control on your investments. In the other context direct equities have high level of personalisation where chances of personalisation in mutual fund investments are lean. Direct equities gives you freedom when to start, halt or stop whereas mutual funds share your journey by getting on and off with other investors. In times of bull run, you can pick and choose the stocks that display excellent fundamentals for direct equities but no pick and choose option available for mutual funds. Few mutual funds have do have a lock-in period but in direct equities you can enter and exit anytime.

Mutual funds fall into three main types:

Equity funds – These are comprise of investments of common stock. These generally earn more money than other types, although they may be riskier.

Fixed-income funds – These are government and corporate securities that offer a fixed rate of return. These are generally pretty low risk investments.

Balanced funds – These investments are made up of both stocks and bonds and they are generally mid- to low-risk.

While